MARKET INSIGHTS: MARKET OUTLOOK 2025

Probably unlike most, I enjoy reading Market Outlook Reports from the previous year and compare them with what actually happened! I normally do this in between Christmas and New year when reports are issued for the coming year. These reports look appealing and well put together and include lots of research and graphs.

However making forecasts about the next twelve months turns out not to be a good guide to anything... hence we don’t send them out (ask me if you want to see them anyway).

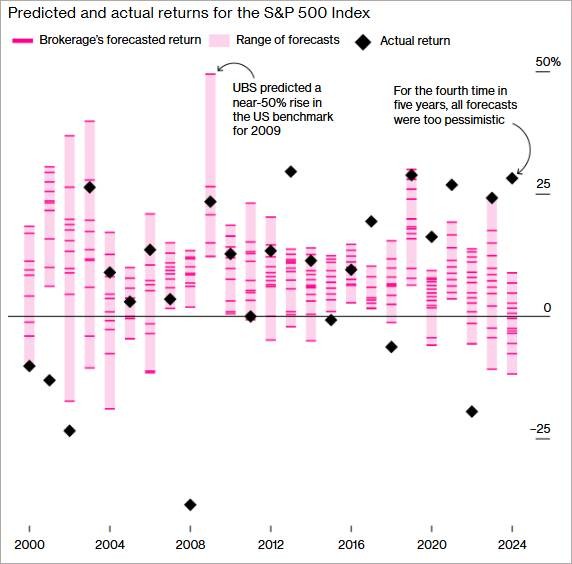

This chart from Bloomberg shows in pink the range of professional (!) forecasters – UBS, Morgan Stanley, Citi, Wells Fargo, Barclays, etc – for where the US market will finish the year. And the black diamonds show where the market ended up. You can see these forecasts have been overly pessimistic in 4 of the last 5 years.

So given this insight we recommend looking beyond the headlines, focusing on what you can control and sticking with a diversified range of investments to meet your planning goals which is where we can help.

Source: Bloomberg LLP.

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

Share this article with your friends by clicking below

COLERIDGE CAPITAL MODEL PORTFOLIO SERVICE

We are delighted to announce that we have formed an Investment Committee and Model Portfolio Service with M&G for the benefit of our clients.

Given the dynamic nature of the market at this time we want to make sure our clients benefit from making revisions to their portfolios on a regular basis. Our Model Portfolio Service will allow for automatic changes to fund managers and investment allocation to manage the level of risk and returns agreed with you. Our existing clients can opt for this service without incurring costs for the revision.

Economic factors as well as fund managers should be closely monitored. We believe that leveraging the resources, scale and research teams of M&G, who manage £370 Billion, will further improve our services.

Of course we continue to retain our status as an Independent Financial Adviser so can make and tailor any solutions to suit your individual requirements, preferences and objectives.

MARKET INSIGHTS: STAYING THE COURSE

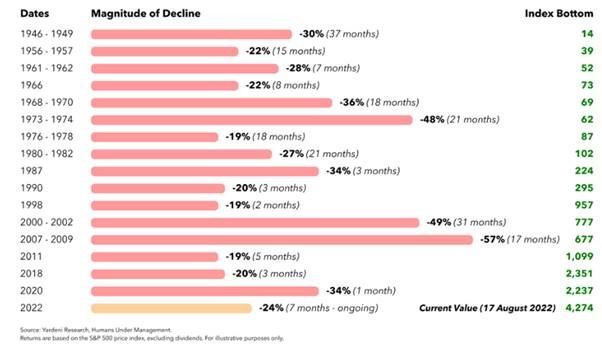

There is a lot of negative sentiment around at the moment and it seems hard to avoid! However, if a long-term investor is trying to understand short term valuations this graphic below may be of interest and provide reassurance.

Bear markets have occurred regularly over the last 70 years, without stopping the market’s permanent advance:

The above relates solely to the S&P 500 – although In practice owning a mix of assets and active management reduces risks and makes returns more steady.

On an emotional level investment sentiment is likely to swing wildly from optimism to pessimism and back again. Sideways with volatility!

We recognise that ultimately the key benchmark clients should care about is achieving their financial and life goals, and not running out of money. Monthly figures are a distraction from long term goals.

On an emotional level investment sentiment is likely to swing wildly from optimism to pessimism and back again. Sideways with volatility!

We recognise that ultimately the key benchmark clients should care about is achieving their financial and life goals, and not running out of money. Monthly figures are a distraction from long term goals.

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below