MARKET INSIGHTS: MAKE THE MOST OF YOUR ISA ALLOWANCE

Typical reasons you might invest in an ISA:

- Accessibility: You can access your funds at any time, making it a practical way to build up capital. Bear in mind that the larger the gains over time, the more valuable the tax free benefit.

- Mortgage Repayment: An ISA can be a smart way to accumulate a tax-free fund that can be used towards repaying a mortgage.

- Long-term Savings: Many clients use ISAs to build a tax-free fund for their retirement provision.

- Private Education: Couples often use ISAs as a means of saving for their children’s private education.

Benefits of a stocks and shares ISA:

- Tax-free Growth: Your investments purchase units in funds covering various geographical regions, sectors, and assets. Ideally, you will benefit from both capital and dividend growth. All income and capital gains from investments within the ISA are currently free from tax.

- Flexibility: An ISA can be a smart way to accumulate a tax-free fund that can be used towards repaying a mortgage.

- Professional Management: Many clients use ISAs to build a tax-free fund for their retirement provision.

Benefits of a stocks and shares ISA:

- No Income Tax: There is no tax payable on income generated from your ISA.

- No Capital Gains Tax: Any capital gains arising from your investments are not subject to tax.

- No Reporting to HMRC: You are not required to inform HMRC about any income or capital gains earned from your ISAs.

ISAs and JISAs are savings options that allow your investments to grow free from income tax and capital gains tax, as per current UK tax legislation. Where possible, I strongly recommend making the most of your annual ISA allowance (£20,000 for the 2024/25 tax year) to grow your savings tax free. Although you have an annual amount you can contribute -any growth is compounded tax free year after year!

If you’d like tailored advice on ISAs and JISA options and how they can fit into your financial plan, contact me for personalised advice. Please note there’s limited time to arrange ISAs before 5th April for this tax year..

If you’d like tailored advice on ISAs and JISA options and how they can fit into your financial plan, contact me for personalised advice. Please note there’s limited time to arrange ISAs before 5th April for this tax year..

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

MARKET INSIGHTS: IT'S NOT AS BAD AS YOU THINK

There’s been lots of excitement in the Olympics and also recently in financial markets. So I thought it timely to highlight an interesting paper from Goetzmann, Kim and Shiller (2024) called ‘Emotions and subjective crash beliefs’.

The authors find strong evidence that investors consistently overestimate the probability of a catastrophic stock market crash compared with the historical frequency of such events, and compared with option prices, which are already skewed. They also find that worries rise after unusual exogenous shocks.

For example, investors significantly raise the probability of an earthquake happening after one has happened. Many people will recognise this trait in themselves, with outlook estimates often tainted and adjusted with the benefit of hindsight, reflecting recent events.

Various factors help explain this anxiety. For starters, negative news is more prominent and memorable than positive news. Investors also display loss aversion, so overestimating crash risk is a way to safeguard individuals against potentially irrecoverable personal financial loss.

The authors also note that institutional investors are marginally better calibrated than individuals when estimating crash risk.

An example is in geopolitics. It’s difficult to get an edge in geopolitics when tensions are slowly but gradually increasing, so positioning for an escalation or normalisation is difficult as markets normally slightly overestimate the risks but are no better or worse at pricing that risk than we are.

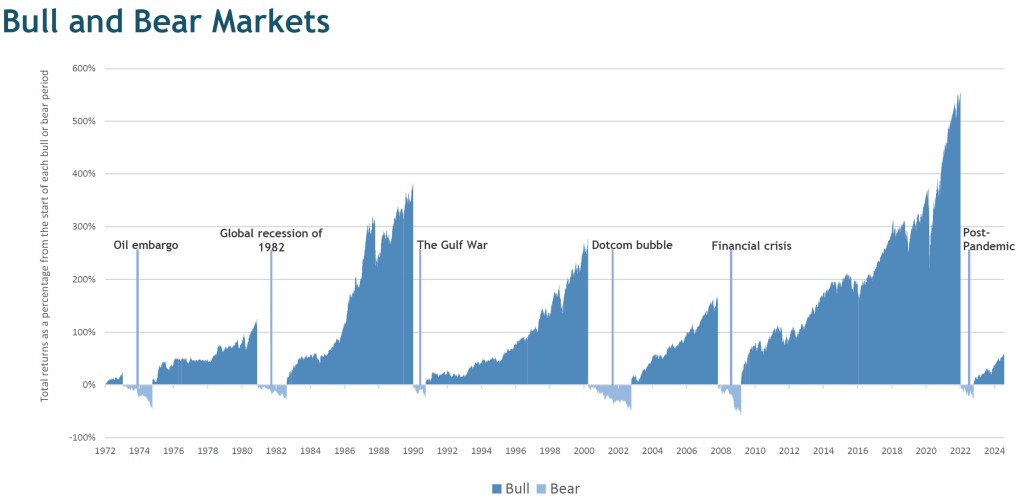

It’s worth noting that most of these tensions pass with little lasting impact on fundamentals. See the chart below for context which shows you’d be much better off staying invested to achieve your outcomes over time.

Source: FE Analytics. MSCI World Index from 3rd January 1972 to 30th June 2024.

Index returns do not reflect management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Please note that this chart is split up into separate bull and bear periods, each of which begins again from zero. So they can be considered as a series of charts run adjacent to each other. A bull/bear market is defined as a 20% rise/drop from its previous peak with a minimum of 6 months duration. Past performance does not predict future returns.

Index returns do not reflect management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Please note that this chart is split up into separate bull and bear periods, each of which begins again from zero. So they can be considered as a series of charts run adjacent to each other. A bull/bear market is defined as a 20% rise/drop from its previous peak with a minimum of 6 months duration. Past performance does not predict future returns.

Risks : Buying Investments can involve risk. The value of your Investments and the income from them can go down as well as up and is not guaranteed at anytime. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. The views expressed here are subject to change without notice and we can’t accept any liability for any loss arising directly or indirectly from any use of it.

To discuss your financial requirements or obtain other information click below

Share this article with your friends by clicking below